Page 11 - July 18, 2024 Bulletin

P. 11

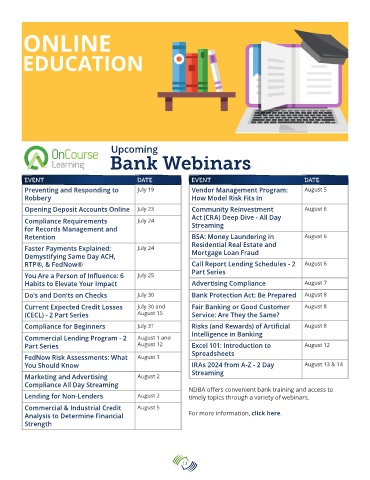

Upcoming

Bank Webinars

EVENT DATE EVENT DATE

Preventing and Responding to July 19 Vendor Management Program: August 5

Robbery How Model Risk Fits In

Opening Deposit Accounts Online July 23 Community Reinvestment August 6

Compliance Requirements July 24 Act (CRA) Deep Dive - All Day

for Records Management and Streaming

Retention BSA: Money Laundering in August 6

Faster Payments Explained: July 24 Residential Real Estate and

Mortgage Loan Fraud

Demystifying Same Day ACH,

RTP®, & FedNow® Call Report Lending Schedules - 2 August 6

You Are a Person of Influence: 6 July 25 Part Series

Habits to Elevate Your Impact Advertising Compliance August 7

Do’s and Don’ts on Checks July 30 Bank Protection Act: Be Prepared August 8

Current Expected Credit Losses July 30 and Fair Banking or Good Customer August 8

(CECL) - 2 Part Series August 15 Service: Are They the Same?

Compliance for Beginners July 31 Risks (and Rewards) of Artificial August 8

Intelligence in Banking

Commercial Lending Program - 2 August 1 and

Part Series August 12 Excel 101: Introduction to August 12

Spreadsheets

FedNow Risk Assessments: What August 1

You Should Know IRAs 2024 from A-Z - 2 Day August 13 & 14

Streaming

Marketing and Advertising August 2

Compliance All Day Streaming

NDBA offers convenient bank training and access to

Lending for Non-Lenders August 2 timely topics through a variety of webinars.

Commercial & Industrial Credit August 5

Analysis to Determine Financial For more information, click here.

Strength

11