Page 47 - February 20, 2025 Bulletin

P. 47

• Service Scope: Fiduciary services focus more narrowly on • Designate compliance officers who are responsible

managing assets with a primary duty to preserve and grow the for enforcing compliance policies and procedures and

client’s assets, whereas wealth management involves broader, ensuring ongoing staff training.

more personalized financial planning.

2. Written Policies and Procedures:

• Approach to Risk: Fiduciaries are generally more conservative • Code of Ethics: Develop and communicate a code

in their investment strategies because of the legal responsibility of ethics that outlines the fiduciary responsibilities,

to protect and preserve trust assets. Wealth managers may emphasizing the duty to act in clients' best interests.

adopt a more dynamic and flexible approach depending on the

client’s goals and risk tolerance. • Conflict of Interest Policies: Identify potential conflicts

and establish processes for disclosure, management, and

While both fiduciary trust services and wealth management services mitigation of conflicts. Ensure that employees understand

aim to grow and protect wealth, their focus and legal obligations their duty to avoid self-dealing or transactions that benefit

differentiate the two. Fiduciary trust services are more narrowly themselves at the expense of clients.

focused on a legal duty to act in the client’s best interests, whereas

wealth management offers a broader set of financial services, • Clear Disclosure Requirements: Policies should mandate

potentially without the same level of fiduciary obligation. full disclosure of any potential conflicts of interest,

so clients are aware of any situation where the bank

Fiduciary trust services may include:

or its employees may have competing interests. This

• Investment management for trusts and estates and for transparency helps maintain trust and accountability.

charitable trust services.

3. Client Disclosure and Transparency:

• Tax reporting, trust structuring and documentation, and

record-keeping. • Clearly communicate all fees, costs, and compensation

arrangements. Ensure clients are aware of how fees

• Guardian and conservatorship services.

are structured, including any performance-based fees,

• Corporate trust services. commissions, or compensation arrangements that could

• Fiduciary advice and guidance, as well as asset protection create conflicts of interest.

strategies.

• Disclose any business relationships or financial interests

• Trustee services (acting as trustee for individuals or that could influence the advice provided to clients.

organizations).

• Distribution of assets in accordance with the trust document or 4. Training and Education:

estate plan. • Regular training for employees and advisers on fiduciary

• Handling complex estate planning. duties, ethical practices, regulatory updates, and how to

Wealth management services are designed to address the customers’ handle conflicts of interest.

financial needs that come with substantial wealth. These services are • A FI’s employees should be well-trained

often strategically customized to help ensure that each aspect of the on compliance policies, ethical standards, and legal

customer’s financial situation is addressed in an integrated way. The obligations. Clear communication about ethical

key components may include: behavior and conflicts of interest help prevent breaches

• Banking and Lending Specialized Products and Services of trust and unethical behavior.

(tailored savings accounts, premium credit cards, and

specialized loan products). 5. Risk Management:

• Trust Services (Estate Planning, Trust Administration, and • Effective internal controls are critical to mitigating risks.

Fiduciary Services). This includes ensuring compliance with regulations and

• Investment Management Services (investment advice, asset conducting regular audits.

allocation, and alternative investments strategies). • Implement procedures for identifying and managing

• Portfolio Management financial and reputational risks related to unethical

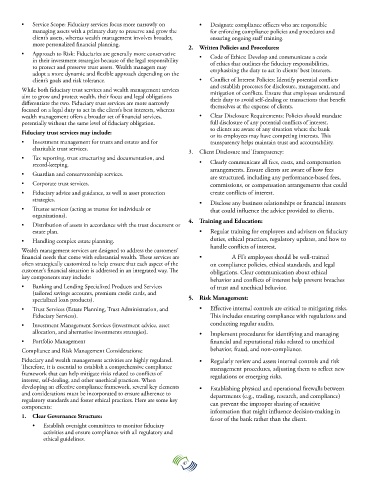

Compliance and Risk Management Considerations: behavior, fraud, and non-compliance.

Fiduciary and wealth management activities are highly regulated. • Regularly review and assess internal controls and risk

Therefore, it is essential to establish a comprehensive compliance management procedures, adjusting them to reflect new

framework that can help mitigate risks related to conflicts of regulations or emerging risks.

interest, self-dealing, and other unethical practices. When

developing an effective compliance framework, several key elements • Establishing physical and operational firewalls between

and considerations must be incorporated to ensure adherence to departments (e.g., trading, research, and compliance)

regulatory standards and foster ethical practices. Here are some key

components: can prevent the improper sharing of sensitive

information that might influence decision-making in

1. Clear Governance Structure: favor of the bank rather than the client.

• Establish oversight committees to monitor fiduciary

activities and ensure compliance with all regulatory and

ethical guidelines.

47